From $364B to $960B: How Nvidia Outpaces Meta, Tesla, and Samsung in Market Cap Growth

Nvidia is a chipmaker that has been dominating the fields of artificial intelligence (AI), gaming and data centers. The company's stock price has soared by more than 160% since the beginning of 2023, reaching a record high of $389.46 on May 26, 2023. This has boosted its market capitalization to over $960 billion, surpassing the likes of Meta ($671 billion), Tesla ($612 billion) and Samsung ($362 billion).

What is driving Nvidia's phenomenal growth?

Here are some of the key factors that have contributed to its success:

AI boom:

|

| NVIDIA's cutting-edge AI research |

Nvidia's chips are widely used for machine learning and AI applications, such as natural language processing, computer vision, autonomous driving and robotics. The company has been investing heavily in developing its AI platforms, such as CUDA, TensorRT and ChatGPT, which enable developers to create and deploy AI solutions faster and easier. Nvidia has also partnered with leading cloud service providers (CSPs), such as Amazon Web Services, Microsoft Azure and Google Cloud Platform, to offer its AI chips and software as a service.

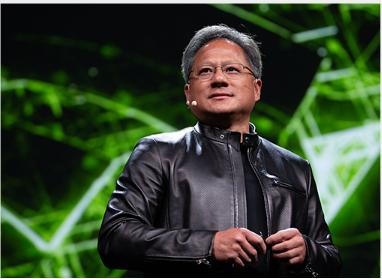

According to Nvidia's CEO Jensen Huang, the company is seeing "incredible orders to retool the world's data centers" to become AI capable. Nvidia's CEO recently announced its plans to bring AI to the masses.

Data centers:

|

| NVIDIA Cambridge-1 AI Supercomputer |

Nvidia's data center revenue hit a record $4.28 billion in the first quarter of 2023, accounting for 60% of its total revenue. The company's data center products include its graphics processing units (GPUs), which are used for high-performance computing (HPC) and AI workloads, and its data processing units (DPUs), which are used for networking and security functions. Nvidia has been expanding its data center portfolio with acquisitions, such as Mellanox Technologies (a provider of high-speed interconnect solutions) and Cumulus Networks (a provider of open networking software). Nvidia has also launched its own ARM-based CPU, called Grace, which is designed to power the next generation of supercomputers and data centers.

Gaming:

Nvidia's gaming revenue was $2.76 billion in the first quarter of 2023, representing a 38% year-over-year decline. However, this was mainly due to the supply constraints caused by the global chip shortage, which affected the availability of its gaming GPUs, such as the GeForce RTX 30 series. The demand for gaming GPUs remains strong, as more gamers are upgrading their systems to enjoy the latest games with ray tracing and DLSS technologies. Nvidia has also been expanding its gaming ecosystem with services, such as GeForce Now (a cloud gaming platform) and Omniverse (a platform for creating and sharing virtual worlds).

Innovation:

Nvidia is constantly innovating and launching new products and technologies that keep it ahead of its competitors. Some of the recent examples include:

ChatGPT: A conversational AI system that can generate natural and engaging responses to any text input. ChatGPT is powered by Nvidia's GPUs and uses a large-scale neural network model trained on billions of words from various sources. ChatGPT can be used for various applications, such as chatbots, customer service, education and entertainment. AI boom is the reason behind surge in demand for GPUs.

Omniverse Enterprise: A platform that enables teams of designers, engineers and artists to collaborate in real time on complex 3D projects across multiple software applications and devices. Omniverse Enterprise leverages Nvidia's GPUs and RTX technology to render photorealistic graphics and simulations. Omniverse Enterprise can be used for various industries, such as architecture, engineering, construction, manufacturing and media.

DGX SuperPOD: A supercomputer that can deliver up to 100 petaflops of AI performance using Nvidia's GPUs and DPUs. DGX SuperPOD is designed to handle massive-scale AI workloads, such as natural language understanding, computer vision, recommender systems and drug discovery. DGX SuperPOD can be deployed in weeks instead of months or years.

Nvidia's future outlook

Nvidia is well-positioned to capitalize on the growing demand for AI, gaming and data center solutions in the coming years. The company expects its revenue to grow by 50% year-over-year in the second quarter of 2023, reaching $11 billion . The company also expects to have more supply of its AI chips in the second half of 2023 to meet the demand .

However, Nvidia also faces some challenges and risks that could hamper its growth potential. Some of these include:

Regulatory hurdles: Nvidia's proposed acquisition of ARM Holdings (a leading provider of chip designs and architectures) for $40 billion is facing regulatory scrutiny from various countries, such as China, UK, US and EU. The deal could face opposition from ARM's customers and competitors, who fear that Nvidia could gain an unfair advantage or limit their access to ARM's technology.

US-China trade tensions: Nvidia's business could be affected by the ongoing trade war between the US and China, which are both major markets for its products. The US government has imposed export restrictions on some of Nvidia's chips to China to prevent them from being used for military purposes or human rights violations. This could limit Nvidia's growth opportunities in China or trigger retaliation from the Chinese government.

Competition: Nvidia faces intense competition from other chipmakers, such as Intel, AMD, Qualcomm and Samsung, who are also developing their own AI, gaming and data center products. Some of these competitors have advantages in terms of scale, cost or market share over Nvidia. For example, Intel is planning to launch its own GPU products for data centers and gaming in 2023 . AMD is also gaining ground in the gaming market with its Radeon RX 6000 series GPUs.

Nvidia's growth has been impressive, and the company is now one of the most valuable technology companies in the world. The company's future looks bright, and it is likely to continue to grow in the years to come.

Nvidia is a remarkable success story in the chip industry that has achieved a massive growth in its market value in a short span of time. The company has been leveraging its strengths in AI, gaming and data centers to create innovative products and services that cater to various customer needs. However, Nvidia also faces some challenges and risks that could affect its future performance. Therefore, investors should be aware of both the opportunities and threats that lie ahead for this chip giant.

No comments: